Rachel Reeves, the Chancellor of the Exchequer, had to concoct a budget that:

- accepted the fiscal rules as decided by the bond markets that hold 2.5 trillion of state debt,so she needed to build a headroom of around £20 billion

- contained enough so called ‘progressive’ titbits to ward off any repeat of the welfare revolt by Labour MPs, the labour movement and campaigners

- could begin to lift Labour’s dire poll ratings which is in part due to people being unconvinced that the government was doing anything to deal with the continuing cost of living crisis

- would help stimulate capitalist investment, business confidence and economic growth

We can add a further concern for Reeves. It was also about saving her own poltical career and that of her boss, Keir Starmer.

How did she do?

What about the progressive bits

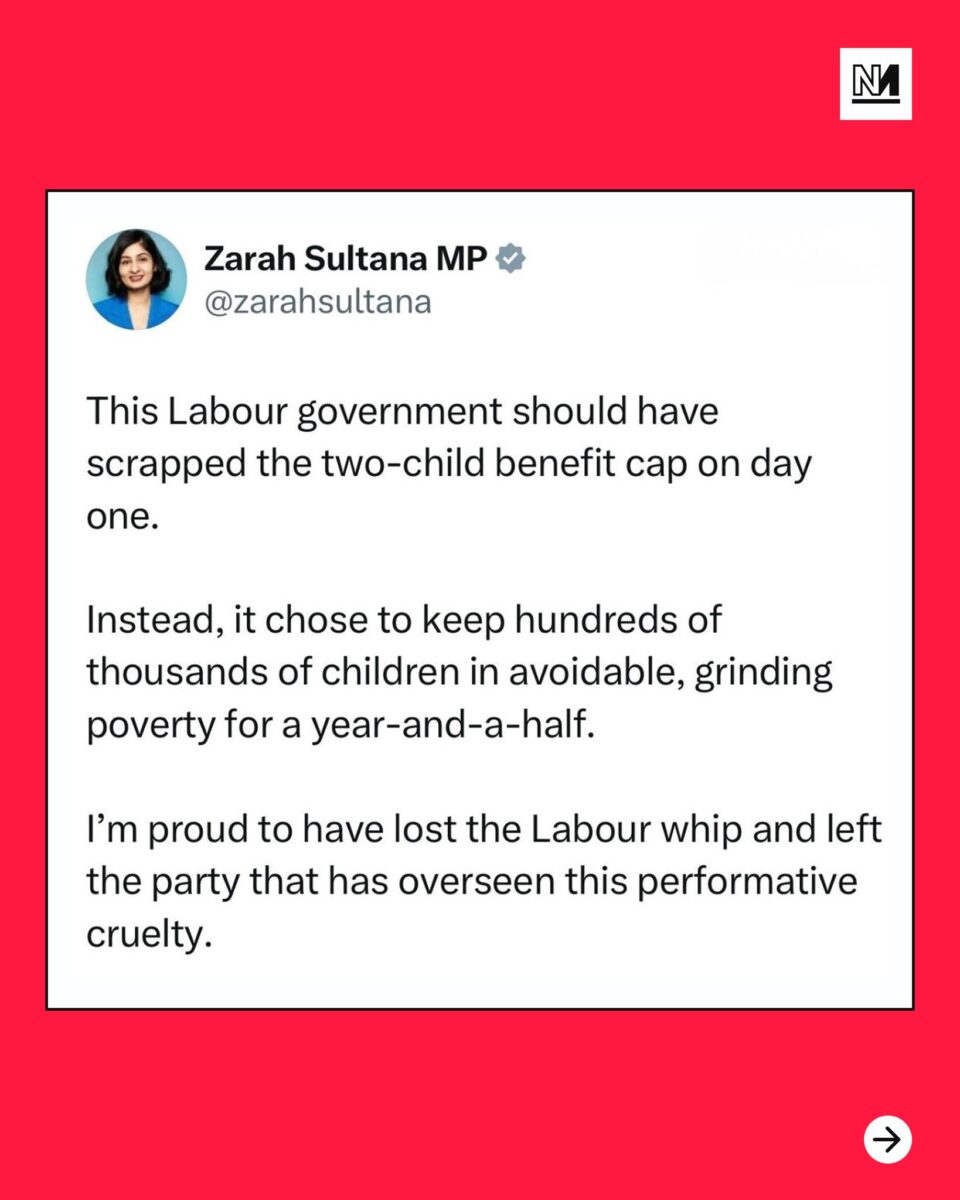

We support (finally!) the ditching of the two child limit which means in future all children will be able to receive welfare benefits. This had been Labour policy for some time and it was in the manifesto but with the caveat that it would happen only when financial circumstance allowed. It will mean there will be a small but helpful improvement in the income of poorer families affecting around half a million children.

Much talk is made by Labour about lifting children out of poverty which is rather exaggerated. It will make some families a little less poor. This is all rather relative since we are not talking of very generous benefits in the first place. Neither does the measure address the fact that many families now able to receive this benefit are working families. In effect welfare spending is subsidising bosses paying low wages or benefiting from the exploitation of part time labour. The Women’s Budget Group has analysed the budget to show that the welfare system is still not particularly generous to women – for example women cannot receive certain benefits unless they work the equivalent of 16 hours at the minimum wage rate. See more detail here: https://www.wbg.org.uk/article/some-positive-steps-for-women-but-more-ambition-needed-says-wbg/

Obviously we also support lifting the minimum wage. However this is already set at such low levels that the state pays out universal credit to these low wage workers. How can anyone live adequately on around £13 an hour in London when renting a room in a shared house starts at around £750 a month before bills? More than half your salary would go just on rent so you would maybe have £600 to £700 for everything else. So this budget hardly even dents what is one of the worst levels of inequality that exists in Europe. The increase barely keeps pace with inflation in any case.

Freezing of rail fares and prescriptions is to be welcomed although our rail fares remain one of the highest in Europe. If the government took back the entire network and rolling stock there would be scope for bigger cuts. Cutting the green energy levy and other non-consumption aspects of energy bills will mean savings for people but the estimates are a little vague and hardly compensate for the huge increases (50% or more) in energy bills over the last few years. Labour promised a cut of £350, this cut looks like being £150. Again if Labour had implemented conference policy on taking back the utilities into common ownership much greater reductions in prices could be envisaged. Profits that could be used for the common good are still being siphoned off to private shareholders in both the energy and water sectors.

Increasing the sugar tax and applying it to milk based drinks is also a welcome move. However much more could be done to encourage healthy eating by taking on the big food producers and the supermarkets. We should be discussing how to begin to limit and eventually ban ultra processed foods completely. It even makes sense because of the savings in the health care costs over time. The problem is that these big corporations are part of the junior partnership Labour is committed to and also they make contributions to party funds.

Are the markets happy?

Fiscal rules appear to be fully met so the markets have had a neutral reaction. There were no increases in taxes on business and some business rates were cut. Even the Liberal Democrats are calling for a windfall tax on the banks. Capital gains tax is still kept at a lower rate that what most workers pay.

The pound has not lost value and bond yields have not risen . Reeves was fortunate that the Office for Budget Responsibility (OBR) reduced current deficit estimates meaning she did not need to cut spending or increase taxes so much. So there will be no Liz Truss meltdown. Remember these rules are set by the capitalist market and in particular by the financiers who control the bond market. By setting up and then genuflecting before the god of the OBR the government is firmly tied in to limiting any progressive spending and keeping taxes low. A radical government truly working in the interests of working people would challenge this framework.

Will the budget boost capital growth and thereby allow a trickle down for social spending? Estimates for growth over the next three years have been scaled back by the OBR so the fundamental justification for Labour’s strategic partnership with capital is further undermined. The OBR has already downgraded predictions on productivity growth – partly due to the Brexit fiasco –over the next years. This makes it even more difficult to see significant growth.

The chancellor also outlined money that will be saved by departments through AI and reorganisation such as abolishing NHS England. All this is assumed and in the past such savings rarely meet targets.

Business leaders are also optimistic that they can further dilute Labour’s new Labour laws. Recently a Labour minister suggested that there was still going to be a lot of consultation with business before the bill finally becomes law.

Are Labour MPs going to accept this is a ‘progressive package’?

The initial response appears to suggest that a welfare revolt on the scale we saw earlier in the year is not on the cards. Reeves was careful not to announce any new welfare cuts. In fact dumping the two child benefit cap represents an increase in spending. It was designed to go down well with Labour backbenchers.

Reeves made a big point in the speech about ending ‘luxury’ cars for disabled people. The changes to the motability scheme are yet another attack on disabled people. The use of language such as ‘premium’ also plays into reactionary notions of ‘scroungers’ as can be seen on social media. Big cars are often necessary given the mobility equipment disabled people need. Disabled People Against Cuts have produced a detailed critique on all this: https://labourhub.org.uk/2025/11/25/motability-cuts-threaten-disabled-independence-and-mobility/.

We still have to wait for the Stephen Timms review of disabled benefits to report back and there is no guarantee that it will not reignite the attack on disabled people. Recently the government quietly slipped in a change to its terms of reference that removed references to current recipients of these benefits

Other measures around freezing rail fares, prescription charges and cutting energy bills are also aimed at keeping Labour MPs on side and winning back popular support. Of course the revolt on welfare reform was preceded by Labour MPs broadly accepting the Spring statement so there is no certainty that this will not happen again. The soft left Labour opposition may be reluctant to rock the boat in the run up to the May 2026 elections. Spending cuts are still continuing in many sectors and in local government spending. Income from the proposed Mansion tax on homes worth more than £2million will not fill that hole. A wholesale review of council tax is necessary to produce a more progressive system. The Mansion tax may be problematic to implement in London where house inflation is high.

Does it address the cost of living crisis?

Will people think this budget will start to improve their living standards? Certainly for most people who pay taxes – including pensioners- freezing tax thresholds until 2031 (a year longer than forecast) is in effect a tax rise. Reeves and the government must think we are stupid and cannot do the maths. If you are a pensioner on a modest income that is greater than £12,570 you will be paying more tax next year. If you are a skilled worker, particularly in London and South East, you could easily now slip into the higher tax bracket and will be paying more tax. Millions will pay more tax. Some analysts have already said people could pay up to £2000 more. This stealth tax will increase its take every year and could prove increasingly unpopular as more and more people are pulled into a higher tax band.

Promising never to increase the main taxes was a daft commitment in the first place. Reeves has even said previously that she was against a stealth tax. If you are managing the economy you need to be able to pull all the levers. A radical left government would not make such a promise since we are in favour of progressive taxation and would raise taxes on higher income people. By swallowing the Thatcherite, right wing mantra about keeping taxes low and drastically reducing the size and role of the state you are making it even more difficult to put forward even a moderately progressive programme. The U turn on raising taxes reflects the cul de sac that social liberal Labourism is now trapped in.

“Reading detail of the OBR report, a worrying element is the growth in household disposable income is predicted to drop from 3% to 1/4%. This means effectively that, despite today’s cost of living measures, a freeze in living standards & for many an ongoing cost of living crisis”. John McDonnell (X/Twitter today)

Although there have been some extra taxes on landlord income, savings interest and salary sacrifice pension arrangements there has been no wealth tax. Some Labour MPs like Richard Burgon have been campaigning for this. Indeed Reeves even boasted how corporation tax on business is among the lowest in the advanced economies. Her speech included all sorts of public investment in infrastructure projects that will boost private companies. She trumpeted how the government was relaxing regulation to facilitate this development.

As we know all this support for developers has not resulted in the government plans for building 1.5 million homes by the end of this parliament being at all credible. Indeed very few of these houses will be for social rent. Housing is a major element in the cost of living crisis.

Will this budget turn around the polls for Labour?

Reform’s lead is not just because the government has not solved the cost of living crisis. Racist anti-migrant rhetoric is a main factor in Reform’s surge. It has not been challenged, but doubled down on by Labour. However the inability of either party to improve living standards does explain the rise of Reform and decline in support for the mainstream parties.

Just as with Brexit or the defeat of Biden merely lining up a series of headline economic figures that might mitigate your situation in the future just does not cut it. Just take inflation, the headline figure does not take into account food inflation is still proportionally higher than the overall figure. Food takes up more of ordinary workers’ income. Calculations after the budget have shown that living standards by 2029 will have barely increased from 2008.

Reeves increased taxes in this budget while saying last Spring she said she would not do. This just reinforces the idea that you cannot trust politicians so this plays right into the hands of far right populists like Reform.

Unless the measures on holding back inflation like the various price freezes and cuts in energy bills compensate for that sense that everything costs more it is hard to see how it will increase Labour’s electoral chances. Kemi Bedenoch, in quite a combative speech, laid out the attack playbook for the Tories and also for Reform. Taxes are going up, welfare spending is not being cut enough, unemployment is rising (true) and business has no confidence in Labour. The Tories displayed their callousness and class hatred in her strident defence of the cruel two child benefit cap. Reform support ending the cap but only for working ‘British people’ to encourage increasing the birth rate!

An eco-socialist alternative

So this budget does not change a great deal. Certainly it may well postpone any significant challenge to Starmer until the May 2026 elections. It confirms Labour’s subordinate strategic partnership with capital. It certainly does not address the climate crisis. New drilling is being permitted in the North Sea. Despite Labour policy is supposed to be no new licenses they argue that these developments are merely extensions of existing licenses. Cuts to the £28 billion green energy plan have not been restored. There is some good news about rail schemes in the North. On the other hand we have the confirmation of a third runway at Heathrow and the Lower Thames road crossing. Both of which are very bad news for the environment.

A radical ecosocialist budget would start from the need to make a fundamental reduction in inequality and a considerable public investment to deal with the climate crisis. It would recognise none of this can be done without challenging the markets and the rule of capital. Just two examples – gambling companies could be taxed not just on their online operations as Reeves did today but for all their operations. You could even move to end private control of gambling because of its negative effects and only allow some limited gambling controlled by the state.

Similarly we need to control some of the key sectors of the economy such as the banks if we want to begin to break with the tyranny of Capital. Such a budget would also require a mass mobilisation of working people to support and implement these changes in the face of a capitalist counter offensive. It is up to those socialists organised in the Greens, Your Party or still in Labour to develop such a radical budget and to help organise workers to carry it forward.

Dave Kellaway offers a sound assessment of the budget revealed on 26 November. Obviously from a socialist perspective the budget fails to reverse the deterioration of living standards for working people, address the inequities in the tax system, sufficiently invest in the NHS and state schools, and restore public ownership to the water industry and the railways.

Reeve’s talk about “we all need to make a contribution”is a smokescreen for increasing the tax burden on workers. Meanwhile the fossil fuel industry, the high street banks,the high tech companies, and the billionaires in our midst get off relatively lightly.

In any event, the budget appears to have placated Labour’s backbenchers, reassure the financial markets and temporarily,at least, has reduced talk of of a leadership challemge to Starmer.

In short, the budget focused on very short term.objectives while dodging how to tackle the institutional levers of power, which lay at the heart of the UK’s economic woes,our inadquate public services, and the deepening climate change crisis.