Donald Trump says that he wants to gain from his introduction of tariffs on goods imported to the US but his economic and trade policies are more than a bit confused. Trump says that he wants to shift industrial production back to the US, he wants to obtain decreased interest rates so as to reduce mortgages and debts. He believes that these aims will cause a revival of the economic prospects of the US on the economic global level.

Trump’s reciprocal tariffs are based on a rather confused and dubious understanding of the meaning (and implication) of trade surpluses and deficits between countries; envisaging trade deficits as a “betrayal of the US”. One thing that is important is that tariffs cause inflation which tends to lead to interest rates rising and central banks raising interest rates. On the day that these reciprocal tariffs were set to come into force, Trump backed down on the introduction of reciprocal tariffs for 90 days except for China which is engaged in a ridiculous trade war. But he left his 10% general tariffs in place for exports from all other countries to the US. What we need to do, is take him at his word and go through what he says he wants and what instead will actually happen.

Why did Trump do this? Primarily, despite his insistence of being a genius, he is actually an ignoramus who doesn’t understand that there is no problem with running a trade deficit with your trading partners. Moreover, in his calculations of the reciprocal tariffs, the fool only took into account goods, but not services. This has led to rather strange results. For example, he put a 20% reciprocal tariff on the European Union because it runs a trade surplus on goods. However, it runs a trade deficit on services with the US. If the EU wants to do a retaliatory tariff on the US they can specifically target US services and that can hit banks, financial services, big tech, etc. and this will significantly hurt the US service industry. Remember that most advanced capitalist economies predominantly produce services.

Trump’s tariffs have upended the post-WWII international economic and political consensus. I’ve recently discussed the changes in US foreign policy which share some similarities with his trade agenda. It is worrying in itself when international trading rules are undermined due to the ignorance of the current President. Additionally, they have also placed the neoliberal economic agenda and globalism under threat with no obvious agreed economic replacement.

Friedrich Hayek

A part of me that has read too many dead white men worries that this was deliberate — that is, the crash of international stock markets and the elimination of “excess capital” invested there could be seen as a “wonderful” way to revive profitability in a stagnant economic system. Maybe I have read too many dead-white economists along with watching “disaster capitalism” in action where human-made and natural catastrophes happen or are created and corporations (i.e., capitalism) comes running into to cash in on various forms of misery. It makes me wonder whether this is a deliberate version of the Keynes-Hayek debate. On the one side Keynes argued in an economic crisis governments should intervene to create growth through the use of a stimulus (see the New Deal). Hayek said just let the market self-correct since who cares about jobs, unemployment or wages.Is this a deliberately created crisis to eliminate unproductive capital and revive everything? But that is probably my paranoia and I am aware of that – but Hayek’s position often reminds me of Marx’s discussion in Volume I of Capital. There he explains what happens during an economic crisis.When the stock market crashes, redundant capital is eliminated, business failures spread, unemployment of labour rises, wages fall, and then everything restarts as things become profitable again.

The advanced capitalist countries have been living under a regime of neo-liberalism and globalisation since the late 1970s-early 1980s. How did this operate:

- “free” trade, focused on export-led growth, which means production for export rather than domestic consumption (cheap workers’ consumption goods are imported into the country);

- free movement of capital; so that capital flows to ensure cost-minimisation in production. Shifts in industrial production away from the advanced capitalist world and increasing difficulty in regulating and taxing profits of multinational corporations;

- the shift of industrial production to the capitalist periphery led to the destruction of trade unions and collapse of working conditions, and the stagnation of money wages in the advanced capitalist world, because workers’ consumption goods are produced elsewhere (so the value of labour power has decreased);

- free trade zones where goods are produced for the international market in the capitalist periphery cheaply and profits sent elsewhere;

- the privatisation of public services and goods.

Neo-liberalism was tested on the capitalist periphery before being employed in the advanced capitalist countries as a way to force countries into a classical free trade regime. The World Bank insisted on these conditions to get loans and Chile under Pinochet was the first target of the economy being run in this way. Rather than create massive economic growth for the advanced capitalist countries through globalization, it has instead created economic stagnation in the advanced capitalist countries. Moreover it did not lead to massive growth in the capitalist periphery either.

Tariffs, Stock Markets, Dollars and Bond Markets

Trump’s threat of reciprocal tariffs has not only caused international stock markets to fall, if this continues, we will be using the term crash. Already we are talking trillions of dollars lost on the stock markets. With Trump’s suspension of the reciprocal tariffs, the stock markets revived, but again started to lose money as treasury bonds started being dumped by investors. Additionally, there has also been dumping of US dollars leading to the weakening of the US dollar (see US dollar index). So, the stock market fell, the value of the US dollar compared to other currencies fell.

There dumping of government treasury bonds which are used to service the US debt is serious and clearly made interest rates rise. This is what made Trump blink in his stupid game of reciprocal tariffs. The US debt is held primarily by US investors, then foreign investors led by Japan ($1 trillion), China and Britain which the three largest governmental holders of US debt. Interestingly several tax havens also hold sizeable amounts of US debt. Japan and China have been selling this off over the years.A decent size chunk was sold off during the pandemic to liquidise assets. Investments in gold have increased. What does this mean for Trump’s economic fantasies?

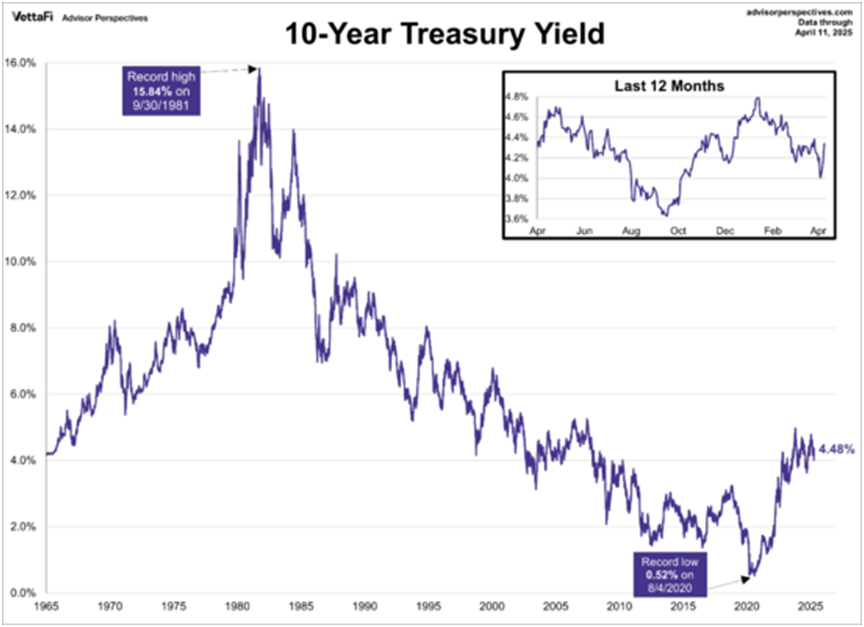

The dumping of US treasuries has led to an increase in the rate of interest, especially on 10yr bonds whose interest rates increased from 3.9% (4th April) to 4.5% a week later. This is the exact opposite of what Trump wanted as he wanted to lower interest rates. Moreover, it is the 10 yr treasury bonds which set the rate of interest especially for mortgages and individual debt and those are the bonds that are being dumped. Trump is literally threatening the Chair of the Federal Reserve Jerome Powell for not lowering interest rates on 2 yr bonds, However, it is his economic policies which caused the dumping of 10 yr treasury bonds and the interest rates earned on treasuries to rise.

So, Trump is really confused here. It is normal that when the stock markets fall strongly alternative sources for investment are sought like the US dollar or the bond market. While Trump has long wanted the US dollar to depreciate thereby making US produced goods cheaper overseas, the bond market crashing out at the same time stopped the reciprocal tariff nonsense for at least 90 days. The bond markets are much more important. That is where government debt is sold and they can impact your credit-worthiness; the bond markets have already brought Liz Truss down. It may be the case that private investors dumped treasury bonds to make their assets more liquid or it may be that governments and individual investors holding US debt decided that it was no longer a safe asset due to Trump’s actions and beliefs.

This destabilises not only the world capitalist economy,but also threatens the US role in it. Many writers argue that it would hurt Japan or China if they dumped treasury bonds, but given the depreciation of the dollar as well, it also reflects a lack of confidence in the US economy itself.

This 90-day reciprocal tariff suspension increases instability; as no one knows what Trump will do next. Will he do the reciprocal tariffs or not, will he revise them, will he abandon them? That is 3 months of uncertainty and this arises because he is so deeply ignorant and confused about economic policy. There is also this bizarre jingoistic nonsense going on as well held across “mainstream” political parties; that the US shall reign economically forever and ever.

One question that exists is whether Trump’s tariff stupidity will have a significant impact on the US as global economic leader. It is already in decline and is the position of the US dollar as the global reserve currency, secure? This is not the first time that the Republicans seem to be seeking the loss of reserve currency status; the fight over raising the debt ceiling last August is an example. China has already been using its currency as a reserve in trades with other Asian countries. One cannot help wondering if this is deliberate and part of the rejection of the post-war consensus or are they also just stupid and don’t understand the impact of what they are doing?

The revival of American Industry?

These tariffs which are supposedly Trump’s attempt to revive American industry, will fail because he does not understand industrial capitalism and how investment happens in industry. You need to understand competition of capitals, investment and profitability In order to understand that.

There are several things which Trump does not understand about industrial production:

This is because Trump is a rentier capitalist who understands “buy low and sell high” otherwise known as mercantilism; that has nothing to do with investment in industrial production and for that matter capitalist production. Mercantilist economic ideas started to become replaced by capitalist economic ideas several hundred years ago (at the end of the 17th century).

A) Industrial production in heavy industry requires a large investment of capital. It requires:

- raw materials (e.g., coal and iron for steel production)

- skilled labour;

- machinery specific to the industry which needs to be in existence prior to starting production

- that machinery needs to be up-to-date as well

- finally, it also requires specialised buildings (i.e., factories).

Hence fixed constant capital must already be in place before production can begin. Labour that knows how to work these newer machines must already be trained to work them. What is relevant here that is that US civilian unemployment is 4.2% (not including those off unemployment benefits). Contrary to what many people think, skills are still relevant in many industries, we have not all been reduced to undifferentiated labour. So does this labour exist or does it need training? Also wages in the US are actually higher than many other countries despite being undermined.

One thing that is very important which has also not been discussed at all by the mainstream media is Trump’s climate change denial. He refuses to recognise that extractivist industries (minerals, fossil fuels) and heavy industry, which he sees as the future of the US, will actually continue the destruction of the planet. Returning to the past is not an easy thing to do and it is even harder economically for a multitude of reasons many of which are discussed here.

B) Industrial production does not just require a sole capital investment in this production period. It requires long-term investment of capital and hence a long turnover period where capital is tied up unlike financial markets and rentier activities. How long you are willing to invest this capital will depend on the potential rates of profit that you can earn in production.

C) There is no guarantee that what you produce will be able to achieve the surplus value in the output. That depends on the costs of production which include:

- the costs of raw materials which need to be produced or purchased prior to production which means getting them out of the ground for industrial production based on extractive industries.

- the wages for skilled labour

- the costs of machinery

- the productivity of the machinery and labour compared to other countries producing the same/similar good.

- rent or ownership of building as well.

You need to be able to sell the output at a price to yield profits as well as find markets for these products. So, it is not only whether you can produce the goods, this is the private sector and hence profits on investments are essential or these goods won’t be produced. I am temporarily ignoring transport costs, but those also are part of costs as well.

As such even if industrial investment in the US occurred and these goods could be produced, they would still be too expensive to sell internationally. The short-termism that characterises investment decisions currently in the advanced capitalist world makes that a bad investment.

It may be another thing altogether if the government nationalized, or socialized, the steel and aluminium industries and made the investment themselves for domestic production, but can you see Trump advocating this? We have seen a large part of Trump’s and the previous Republican policies opposing the Federal Government running functional and necessary programs and have tried to disband the bodies running these programs. Nationalisation, or socialization, under Trump is doubtful; so that means that profitability criterion (or expected profitability and demand)is essential and therein lies the problem.

Yesterday, the UK Parliament (Commons and Lords) was recalled in an emergency session to discuss whether to keep a company called British Steel running. British Steel had been bought by a Chinese company Jingye in 2020 which had already invested £1.2 billion, but the plant was hemorrhaging money. The discussion specifically related to keep the last plant in Britain that could make steel from scratch running. If blast furnaces were shut down, reopening the plant would be very expensive, so purchase of raw materials were essential. The Emergency Law was passed enabling the government to take control and manage British Steel and probably it will be nationalized.

Trump’s attempt to conflate the success of the market (private sector) with the success of the US aligns with how the vast majority of American politicians view the US. Hence there is a logic to the slogan MAGA – strengthening the market will in his opinion, make America great again. However, it is neither poorly paid jobs, a dearth of services (e.g., health, education, welfare, social care, etc), nor miserly pensions that makes things great for the majority … and that is all that Trump is offering. Unfortunately the Democrat Party is not offering much better. Incidentally think of the consequences if social security had already been privatised and the markets crashed.

So, what will a tariff on goods produced internationally and exported to the US, actually do?

Tariffs will increase the price charged byinternational producers of intermediate goods (machinery, processed raw materials),finished industrial goods and consumption goods if they require inputs produced overseas.

All these tariffs will do is create inflation for both consumers and producers in the US. It will drive up costs for producers and, as a result, prices will rise for consumers. Contrary to what Trump believes, tariffs will be passed from producers onto consumers directly or indirectly. So, the prices of final working-class consumption goods produced internationally will increase directly due to the results of the tariffs.

If inputs used in the production of these consumption goods increase in price due to the tariffs, the price rise will lead to an increase in prices for final purchasers or it will lead to a decrease in profits of the corporations. So, while Trump is thinking that this will force corporations to produce in the US there is no guarantee that this will happen as the costs to produce in the US may be too expensive and profits will be too low anyway. The US is a large market but it is not the only market in the world. So, producers will look for another market where they can sell their products, if the rate of profit they can earn is too low for producing and selling in the US. Remember production (supply) does not create its own demand necessarily or the realisation of profits, that depends on sales, the price of the good and that depends on demand. That is something that a lot of mainstream economists forget; this is tied to neo-liberalism and globalisation and why we find ourselves in stagnant economies or very low growth economies in the advanced capitalist world.

Walmart has made massive profits on cheap products made in India, Cambodia, Malaysia, Indonesia, Vietnam etc – you heard these names recently, they are the countries that Trump slapped with really high reciprocal tariffs. The price of these goods produced for and then sold by Walmart has now risen by 10% due to the tariffs. Imagine if these were Trump’s proposed higher reciprocal tariffs. Additionally, Walmart has undercut wages and working conditions in the US for their workers; that also holds for workers internationally producing their products. While I will not mourn Walmart, it was the ultimate model of horizontal production internationally and super-exploitation of workers as well. Large numbers of working-class people, especially women who are not given enough hours to get benefits, sick days and holidays, work for Walmart and many of the poorest working-class Americans buy their cheap goods there. I am wondering how people will be able to buy these goods now? I am also wondering how many of these people voted for Trump. Do you think that maybe he did not think this through or, perhaps, he really doesn’t care about his voters?

During and after the pandemic we saw the increase of energy, food and necessary consumption good prices (e.g., clothing, shoes, household products).Real wages and workers’ incomes (wages and benefits) had already been cut due to rising oil and hence transport costs. Even the Tory-led British government, which had limited yearly public sector wage growth to 1% to bring it into line with the private sector, were forced to give a cost-of-living increase to benefits and minimum wages.

Producing for export enables producers to screw over their working class by keeping wages low and destroying working conditions and trade unions but this has not led to massive increases in profits and economic growth. Whether this model of growth worked depends on your ability to sell goods internationally at a profit and to invest and reinvest it in places where you can make a profit. Consequently, globalisation and the shift of industrial production to places with the cheapest costs has clearly created stagnant economic growth and low wages in the advanced capitalist world. The destruction of jobs and services and the failure of mainstream politicians to actually help their domestic working class and abandon neo-liberalism has led to the rise and consolidation of the far-right internationally. This has also impacted support for “the post-war liberal consensus.”

Even more the rise of financialisation has increased the instability of the capitalist system itself. Crises are more common and “recoveries” have not led to increases in employment domestically. The ruling class knows the system is more unstable and globalisation means the system is far more interconnected than it was before the New Deal.

Stock Market Crashes and the Real Economy

One of the strangest things that occurred when the stock markets lost so much value was that most of the MSM concentrated on the impact on the finance sector, not the real economy. What happens when there are tariffs, real wages buy less because prices rise and the rate of interest will rise for borrowing and mortgages. At this point this will affect only US consumers due to his 10% tariffs.

What happens if the stock market actually crashes? This can lead to businesses cutting staff and closing down completely. It can lead to further cost-cutting exercises such as lowering money wages further on the threat to workers of job losses. Unions often capitulate in these situations. Jobless recoveries have been the norm following recessions for quite some time now; every time it happens, the mainstream media act surprised.

I spent the week following the mainstream media and they never mentioned how the stock market crashes and the rate of interest rises impact on us. The other thing they never talked about (maybe it was different in the US) was our pensions. I had to go to specific consumer sites to see what they had to say about the loss of value on the stock markets. State pensions have been under threat of privatisation by the US government for years. The day it will pay back the $2.9 trillion it borrowed from Social Security will be a cold day in hell. Economic doyens say that the interest earned through Congress borrowing from Social Security actually keeps Social Security going. If they raised the cap that would also help “keep it going”.

Stop and think of what would have happened if social security was already privatised and the markets crashed? One of the major changes that has happened in my lifetime was the shift from defined benefit pensions where you had an income for life to defined contribution pensions which are invested in the stock markets. This was part of the change in the nature of pensions that we saw during the neoliberal period to draw workers’ savings into the stock markets adding to the funds already tied to the markets, and, of course, tied to the vagaries of the financial markets. This has left working class people far more vulnerable to crashes in the financial markets; the financial markets are by their nature, unstable and the fall in the financial markets have impacted working people, not only the ruling class.The financial markets are by their nature unstable and the latest losses have impacted working people, not only the ruling class.

Going to a consumer protection site to see what they were advising about the falling stock market the only advice you could find was to sit tight. But what if you were planning on retiring soon … sit tight doesn’t really work. So retiring may not be an option as you sit and wait for the stock markets to bounce back.

Because of the changes in the pension system, those significant falls in the stock markets also undercut workers’ pensions which are tied up in the stock market and these are the majority of pensions beyond social security or a state pension. We are not talking about billionaire capitalists, but the pensions of workers from public and private sector employers and the self-employed. Many of the latter were forced into self-employment when contracts were eliminated so that bosses didn’t have to pay social security and benefits; their pensions in the US are in 401Ks and Keogh Plans. Retirement accounts like the US IRAs or ISAs in Britain can also be in stocks and will also be adversely affected by stock market falls.

Unlike the investment profiles of the rich, this was our retirement money, for us it is real. If we lose that, what will we live on? State pensions in Britain are among the worst in Europe; historically you could survive decently on social security.

One way to think about how different it is for us and how different it is for the ruling class is think how much Tesla stock has fallen both before and during the crash and Musk has lost billions; but that is only money on paper for him, it is not real. What is real money to Musk are the Tesla cars bought by the US government, that is literally government funding of his company. What do conflict of interest laws actually do anyway! How can Trump announce on his Truth Social site to invest in his business as something big is coming … I still don’t understand why those in power cannot be prosecuted for their perfidy and corruption? They don’t even bother to pretend anymore …

Apologies for the penguins, they are my way of coping …