Long-form theoretical piece.

Abstract: The period from 2008 into the third decade of the twenty-first century has been one long protracted crisis for global capitalism, as much structural as political, that has been aggravated by the coronavirus pandemic. The era of globalization has involved an ongoing radical transformation in the modalities of producing and appropriating surplus value. There is an extreme and still increasing concentration and centralization of capital on a global scale in the financial conglomerates that in turn act to interlock the entire mass of global capital. Now the system is undergoing a new round of restructuring and transformation based on a much more advanced digitalization of the entire global economy and society. The agents of global capitalism are attempting to purchase for the system a new lease on life through this digital restructuring and through reform that some among the global elite are advocating in the face of mass pressures from below. Beyond transnational policy coordination among states, the structural power that the transnational capitalist class is able to exercise from above over states will undermine reform unless there is a mass counter-mobilization of power from below. If some regulatory or redistributive reform actually comes to pass, restructuring may, depending on the play of social and class forces, unleash a new round of productive expansion that attenuates the crisis. In the long run, however, it is difficult to see how global capitalism can continue to reproduce itself without a much more profound overhaul than is currently on the horizon, if not the outright overthrow of the system.

If the history of capitalism is one of never-ending transformation, crises often mark before-and-after turning points. The period from 2008 into the third decade of the twenty-first century has been one long protracted crisis that, far from resolved, has been aggravated by the coronavirus pandemic. This crisis is as much economic, or structural, as it is political, one of state legitimacy and capitalist hegemony (Robinson, 2014; 2020; 2022, in press). As many have noted, it is also existential because of the threat of ecological collapse as well as the renewed threat of nuclear war, to which we must add the danger of future pandemics that may involve much deadlier microbes than coronaviruses. Can global capitalism endure? Indeed, will humanity survive? These are, to be sure, two distinct questions. It is entirely possible that the system endures even as a majority of humanity faces desperate struggles for survival that lead many to perish in the coming years and decades.

Each major crisis in world capitalism has involved predictions that the system would collapse in on itself in the face of intractable contradictions. Yet capitalism has repeatedly proved to be more resilient and adaptable than its doomsday forecasters. As we shall explore in this essay, the system has been undergoing a new round of restructuring and transformation since the financial collapse of 2008, based on a much more advanced digitalization of the entire global economy and society. The contagion has turbo-charged these transformations. The agents of global capitalism are attempting to purchase for the system a new lease on life through this digital restructuring and through reform that some among the global elite are advocating in the face of mass pressures from below. If some regulatory or redistributive reform actually comes to pass, restructuring may –depending on the play of social and class forces– unleash a new round of productive expansion that attenuates the crisis. In the long run, however, it is difficult to see how global capitalism can continue to reproduce itself without a much more profound overhaul than is currently on the horizon, if not the outright overthrow of the system.

The challenge for radical political economy is to capture the motion of structural change and to identify possible trajectories and outcomes that are always contingent on politics and class struggle. And the challenge for radical intellectuals is to contribute through theory and analysis to exposing the contradictions of the prevailing system as input into the burning struggles of our day. As I attempt to take up these challenges, the usual caveats apply. Our explorations of the world are always an open-ended process of clarification and revision. The account here is necessarily a simplification, as are all synopses of complex reality that attempt to present a «big picture». This is an exploratory essay, with some theoretical passages tentative in nature. As such, all conclusions are preliminary.

The Structural Dimension of Global Crisis

World capitalism has experienced over the past two centuries several episodes of structural crisis, or what I call restructuring crises, so-called because the resolution of such crises requires a major restructuring of the system. Here «resolution» means displacement in time and space through restructuring that paves the way for a new burst of sustained accumulation and outward expansion after a period of stagnation and malaise. Eventually the underlying contradictions of the system build up and erupt into new crises, often triggered by a precipitating event, such as the bursting of a speculative bubble or a political watershed moment.

The first Great Depression from the 1870s into the 1890s led to the great wave of late nineteenth century imperialism, the rise of powerful national corporations, and ultimately to the First World War and the Bolshevik Revolution. The Great Depression in the 1930s sparked intense worldwide class struggles and political upheavals, bringing in their wake fascism, the Second World War, and eventually the consolidation of a new model of redistributive or regulated capitalism. Known as the New Deal in the United States and elsewhere as Social Democracy, what we can call more technically Fordist-Keynesian capitalism established the basis for the post-WWII boom, the so-called golden age of capitalism. The next structural crisis that of the 1970s, characterized by «stagflation», or the combination of stagnation and inflation, was «resolved» through globalization. The system underwent a period of radical restructuring, transformation and expansion in the late twentieth and early twenty-first centuries, involving the rise of a globally integrated production, financial and service system as capital went global and reorganized its worldwide circuits. Unlike the situation in earlier structural crises, in this age of global capitalism the world economy is now inextricably integrated and functions as a single unit in real time.

Structural crises have their origin in overaccumulation. This refers to a situation in which enormous amounts of capital (profits) are built up but investors cannot find productive outlets to unload the accumulated surplus. This capital then becomes stagnant, as capitalists pull back from reinvesting profits, throwing the system into crisis. Overaccumulation originates in the circuit of capitalist production, ultimately in the tendency for the rate of profit to fall.

In fact, the average rate stood at about fifteen percent in the post-WWII period, dropped by the end of the 1980s to ten percent and continued to decline, to six percent in 2017 (The Economist, 26 January 2019). But overaccumulation is typically expressed as a realization problem, manifest in the market as a crisis of overproduction and underconsumption. In 2018, the richest one percent of humanity controlled more than half of the world’s wealth while the bottom eighty percent had to make do with just five percent (Oxfam, 2020). Such inequalities –the natural outcome of capitalist dynamics unchecked by countervailing tendencies that may offset social polarization– end up undermining the stability of the system as the gap grows between what is (or could be) produced and what the market can absorb. Overaccumulation thus appears first as a glut in the market and then as stagnation. In fact, from 2008 to 2020 there was a steady rise in underutilized capacity and a slowdown in industrial production around the world (Cox, 2019; Toussaint, 2020). The surplus of accumulated capital with nowhere to go expanded rapidly. Transnational corporations recorded record profits during the 2010s at the same time that corporate investment declined (The Economist, 26 May 2016). Note that there is a double movement here: the rate of profit has fallen while the mass of profit has risen. The total cash held in reserves of the world’s 2.000 biggest non-financial corporations increased from $6,6 trillion in 2010 to $14,2 trillion in 2020 –considerably more than the foreign exchange reserves of the world’s central governments– as the global economy stagnated (The Economist, 16 May 2020).

While the accumulation of such profits may be good for individuals who get rich it represents a problem for the system overall, structurally speaking, as capital cannot remain idle without ceasing to be capital. In recent years accumulation has sputtered forward in ebbs and flows as the transnational capitalist class (henceforth, TCC) has searched for outlets to unload this mounting surplus. Wild financial speculation and escalating government, corporate, and consumer debt drove growth in the first two decades of the twenty-first century but these are temporary and unsustainable solutions to long-term stagnation. Consumer, corporate, and state debt reached an all-time high of $281 trillion in 2020, more than 355 percent of the total gross world product (Maki, 2021). Such debtdriven growth is simply unsustainable in the absence of significant redistribution and other structural changes away from neoliberal policies. A major default on consumer, state, or corporate debt –or waves of defaults– would set off a further chain reaction in the downward plunge of the global economy.

The other, frenzied financial speculation in the global casino, points to more fundamental transformations in the global political economy. Financialization began in the late twentieth century with the deregulation and liberalization of financial markets worldwide, along with the introduction of computer and information technology into these markets. As national financial systems merged into an increasingly integrated global financial system, transnational finance capital emerged as the hegemonic fraction of capital on a world scale. It accrued enormous social power, including the ability to dictate through global financial markets to states and to other circuits of accumulation (Robinson, 2014), to regulate the circuits of capital worldwide, in a reversal of the historic relationship in which finance serves as an adjunct to industrial capital. There is now a body of literature on this financialization too vast to reference here (but see inter alia, Marazzi, 2011; Tabb, 2012; Krippner, 2012; Durand, 2017; Prins, 2019; and for my own analysis, Robinson, 2014, chapter four). Yet the phenomenon in my view still remains poorly understood and under-theorized. In part, this is because the changes in the nature of global capitalism that financialization –if indeed that is the best way to describe it– involves are so profound and are occurring so rapidly that it is difficult to get a handle on them. The matter is complicated by the twin process of digitalization, which makes possible financialization and is bringing about a radical restructuring of the whole system, a matter to which I will return momentarily.

Financialization has made it possible to turn the global economy into a giant casino for transnational investors. As opportunities dry up to reinvest overaccumulated capital elsewhere in the global economy the TCC has turned to unloading trillions of dollars into speculation in global commodities markets, stock markets, currency markets, futures markets, leverages, every imaginable derivative and short, cryptocurrencies, «land grabs», and urban real estate, among other speculative activities in the netherworld of shadow banking. These speculative markets become outlets for global investors to «park» their overaccumulated capital. As a result, the gap between the productive economy of goods and services and fictitious capital has grown to an unfathomable chasm. Fictitious capital refers to money thrown into circulation without any base in commodities or in production. A major portion of the income generated by financial speculation is fictitious, meaning (here in simplified form) that it exists on paper or in cyberspace but does not correspond to real wealth in the world, that is, goods and services that people need and want, such as food, clothing, houses, and so on. The accumulation of fictitious capital through speculation may offset the crisis temporally into the future or spatially to new digital geographies and new population groups but in the long run only exacerbates the underlying problem of overaccumulation. In 2018, for example, the gross world product or the total value of goods and services produced in the world, stood at some $75 trillion whereas the global derivatives market –a marker of speculative activity– was estimated at a mind-boggling $1,2 quadrillion (Maverick, 2018)1.

1 Durand reviews the growth of fictitious capital in the form of credit to the non-financial private sector, public debt, and the stock market. He observes: «The different basic forms of fictitious capital combined to ensure that, overall, this category expanded across the whole period in question, including after the 2008 crisis. In other words, over the last three decades, the quantity of value validated in anticipation of future valorization processes has constantly increased relative to the quantity of wealth actually produced» (Durand, 2017:65).

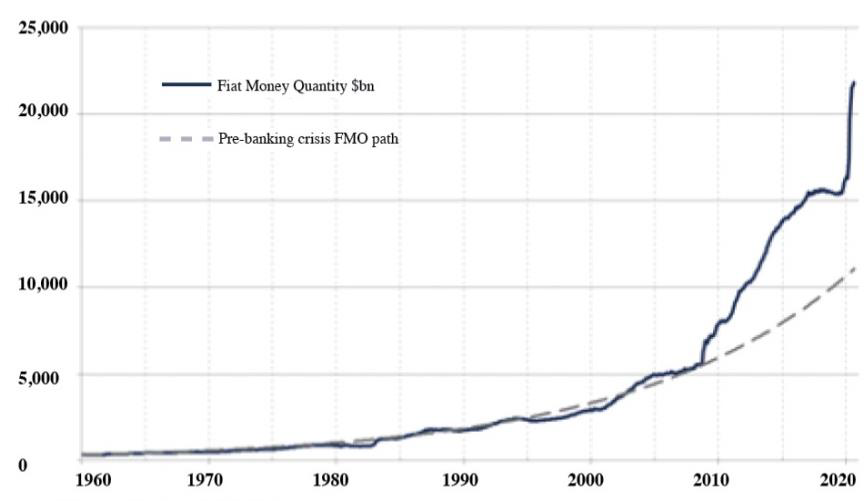

In the wake of the 2008 financial collapse, the U.S. and other Western governments turned to policies known as «quantitative easing», which essentially means that government treasuries print money and inject it into the banking system as cheap credit, even involving negative interest rates. Quantitative easing ends up creating mountains of what is known as fiat money, or government-issued currency that is not backed by a commodity, aggravating the gap between fictitious capital and the productive economy. Apart from the prospects of collapse itself, the out-of-control printing of money may in the long run trigger uncontrolled inflation that would further destabilize the global economy. This accumulation of fictitious capital gave the appearance of recovery in the years following the Great Recession. But it only offset the crisis temporally into the future while in the long run it exacerbated the underlying problem. Through its quantitative easing program, the U.S. Federal Reserve undertook a whopping $16 trillion in secret bailouts to banks and corporations from around the world (GAO, 2011) following the 2008 collapse. But this only tells part of the story. According to one IMF report (2009), the total amount that states and central banks in the «advanced economies» committed to supporting the financial sector amounted to 50,4 percent of the entire world GDP. This figure alone should make clear the profound transformations in global finance to such an extent that the crisis that began in 2008 is distinct from all earlier ones and places global capitalism in unchartered territory. The banks and institutional investors that received much of this support simply recycled the trillions of dollars into new speculative activities, contrary to Keynesian expectations that it would stimulate productive recovery. As opportunities have dried up for speculative investment in one sector the TCC simply turned to another sector to unload its surplus. Then, as the global economy fell into free fall in 2020 many governments turned to massive bailouts for capital. The U.S. and EU governments provided an astonishing $8 trillion handout to private corporations in the first two months of the pandemic alone, an amount roughly equivalent to their profits over the preceding two years (The Economist, April 2020). Most governments around the world approved packages that involved the same combination of fiscal stimulus, corporate bailout, and modest public relief, if at all it was provided (IMF, 2021). Recycled into further speculative activity, the injection of state funding into the global financial system during the pandemic expanded even further the gap between the productive economy and fictitious capital as bubbles kept the capitalist economy afloat. The figure below shows the growth in fiat money measured within the United States, indicating the sharp spike from 2008 and on, and then an almost vertical spike with the onset of the pandemic.

The Global Production, Circulation, and Appropriation of Value

The era of globalization has involved an ongoing radical transformation in the modalities of producing and appropriating surplus value, a transformation hastened first by the 2008 crisis and now again by the pandemic. The globally integrated financial system that emerged in the early twenty-first century has made it possible for values to cross borders seamlessly as they move swiftly and often instantaneously through the new global financial circuits. Money capital may be able to open or close gates for the generation of wealth within the logic of capitalist accumulation (of exchange value) but it does not in itself do anything except to have real values stick to itself. Fictitious capital cannot produce surplus value but it can redistribute it. The triple processes of globalization, financialization and digitalization are modifying how this value is created, distributed, and appropriated around the world. This is to say that the contradiction between value-production and value-realization is taking on new forms that require study.

Faulkner and Hearse (2021) suggest we need to rethink the relationship between the theory of value and the laws of motion of capital lest we conflate two different registers of activity and levels of abstraction. «The labor theory of value (which is correct; all value is created by labor) has to be separated from the laws of motion of capital accumulation», they argue, «i.e. the laws that govern circuits of capital, and the way in which those circuits determine wages, prices, and profits, and thus the distribution of value between and within social classes». I am not so sure, however, that they are two difference registers as much as two different moments in the circuit of global capital insofar as capital as a relation is value in motion, that is undergoing radical change in the face of globalization, financialization, and digitalization. I do concur that we need a theory of the distribution of value as it pertains to the current epoch of globalized capitalism and transnational finance capital.

The rise of a deregulated, globally integrated and digitalized financial system allows capital to transform any current or future stream of earnings (dividends, interest, mortgages, credit card payments, state and private bond maturities, commodity deliveries, and so forth) into an easily tradable capital asset. And then, in turn, it achieves the ability to speculate further through trade taking place at a second degree of separation from the original productive origin of the stream of earnings and from the financial instrument being traded (Robinson, 2014). Theoretically, there can be an endless degree of separation of this speculation from the original productive generation of value, so that fictitious capital becomes ever more divorced from the «real» (or productive) economy. That is, frenzied trading in money that never leaves cyberspace involves ever –greater degrees of separation from any underlying tangible values– assets or wealth produced by human beings. The initial creditor, say for a mortgage loan, sells it onward to high risk derivatives traders so that the banks and investment management funds are free to seek speculative profit with no concern for the actual material assets and the people tied to them (e.g., a house), that is, for the gains and losses of derivative purchases. Indeed, they place bets on those gains and losses!

Historically a portion of the surplus value that originates in production (in the capitalist labor process) is redistributed through circulation. The first appropriation of surplus value is by capitalists that purchase labor power and organize the labor process, and this may take place in each phase in the production of a commodity. The second is by other capitals that appropriate portions of the original value in circulation as it becomes realized. But in recent decades the gulf has rapidly widened between the original production of surplus value at the points of production and its appropriation elsewhere in the global economy by circuits of financial capital that appear far removed from that production (Robinson, 2014).

For Faulkner and Hearse (2021), critical to understanding financialized capitalism and the permanent debt economy is: «a) the scale of surplus appropriation that now occurs not in production, but in circulation; b) the extent to which the locus of exploitation has shifted from the proletarian as worker to the proletarian as consumer/debtor». Indeed, household indebtedness itself involves not just an escalation of secondary exploitation, that is, appropriation of values that is independent of the extraction of surplus value in the production process. It also signifies a substantial increase in financial domination over the social reproduction of the working and popular classes, and an increase in value appropriation that bypasses value production (the production of new surplus value), and therefore ends up aggravating the overaccumulation problem.

Twentieth century research from the perspective of world-systems and dependency theory showed how surplus produced in peripheral regions of the world economy were transferred through unequal exchange, multinational corporate transfer pricing, and other mechanisms made possible by unequal specialization in an international division of labor (see inter alia, Wallerstein, 1983). As globalization proceeded towards the end of the century, scholars operating in this framework developed the concept of international value chains, what they referred to as global commodity chains (Gereffi and Korzeniewicz, 1993). This approach focused on how value is added to commodities in distinct phases in their production scattered across many countries. Higher value-added phases accrue more income and benefit particular geographic locations, generally conceived as particular nation states.

Applying this approach, Clelland (2013) argued that behind the «bright value» of «visible monetized flows» of wages, rent and profit, lay what he called «dark value», involving the capture of value by participants controlling one node in a commodity chain from participants in other nodes as well as unpaid labor inputs from households and communities (unpaid social reproductive labor). Capitalists who capture dark value can use it to roll back prices in order to attract a greater volume of consumers than their competitors, to reinvest in expanded accumulation, or to achieve a greater degree of monopoly within commodity chains. The capitalists who achieve greater monopoly control are able to capture a portion of the surplus generated by others in a lower position within the hierarchy of the commodity chain by mark-ups and mark-downs in the prices at each node in the chain, in particular, the margin between the cost of production and the market price of inputs throughout the chain (this would be the mechanism of transfer pricing, but now not within a single corporation but between a subcontracted and a core firm). Focusing on the Apple iPad commodity chain, Clelland showed that Apple collected the lion’s share of the difference between the factor price and the market (sales price) of an iPad as a result of its control over the supply chain and its monopoly position in the chain. In order to remain competitive, suppliers in the chain are forced to extract dark value from low-paid labor power, low-cost natural resources, and externalization of costs to ecosystems and households.

The commodity chains research was a good starting point to understand the radical changes underway in the relationship between the production and the appropriation of values in the global economy. But it is limited on several counts. By attributing the capture of value by nodes higher up in the chain to exploitation by core of peripheral countries it obscures the underlying transnational social and class relations that drive the production and appropriation of values. As the research into the transnationalization of capital has shown (see inter alia, Robinson, 2014; Robinson and Sprague, 2018; Phillips, 2018), global corporate conglomerates cannot be identified with particular countries and the value extracted through unequal exchanges in commodity chains cannot be seen as appropriated by a country. Phillips has documented that in 2018, just 17 global financial conglomerates collectively managed $41,1 trillion dollars, more than half the GDP of the entire planet, and that these conglomerates are so transnationally entangled among themselves that separating them out into national boxes or into clearly delineated companies is simply impossible. In his words, they constituted «a self-invested network of interlocking capital that spans the globe» (Phillips, 2018:35).

We are witness to an extreme concentration and centralization of capital on a global scale in the financial conglomerates that in turn act to interlock the entire mass of global capital. It becomes clear that the notion of «national corporations» is too amorphous to be meaningful and that individual companies such as Apple are organizational units within a larger mass of entangled global capital. Value does not become pinned down in particular national boxes as it flows through the «open veins» of the globally integrated financial system. In failing to analyze the structure of global capital, extant approaches take an incorporated company, such as Apple, as the fixed unit of capital and thus conceal underlying relations of ownership and control that determine value appropriation. More to the point here, the global commodity chains and related approaches appear to focus wholly on industrial and commercial processes. They show how value is appropriated throughout a production chain but do not analyze financial capital that appropriates from productive and commercial capital.

Absent an analysis of finance, these extant approaches are of little help in identifying the increasing hegemony of transnational finance capital in driving global accumulation and value appropriation. It no longer clear that the value appropriated by capital corresponds to distinct phases of production and circulation of commodities, much less any necessary correspondence between the processes of appropriation and distinct national geographies. Let us recall that fictitious capital is fictitious valorization until or unless it is realized not on paper or in cyberspace but in the real material world.

If the top TNCs such as Apple perform a «system-integrator» function (Cox, 2013), they in turn are enmeshed in and subordinate to the web of transnational finance capital. Moreover, researchers have long noted that industrial corporations have experienced financialization as they move into global financial markets and their financial operations shape decisions with regard to production, so that industrial corporations such as Apple have themselves become financial groups. Perched at the apex of the hierarchy in the iPad chain, Apple appropriates value from capitals supplying inputs and assembly in the supply chain, as Clelland documented. But who owns Apple? The billionaires and multimillionaires who are the face of Apple capitalists owned in 2021 but a few percentage points of the company. The three top individual shareholders, Arthur Levinson, Tim Cook, and Jeff Williams, together held barely more than one percent. In contrast, the three top institutional investors, Vanguard Group, BlackRock and Berkshire Hathaway, owned more than 20 percent of the company (Reiff, May 2021). In 2021 BlackRock was the largest asset management firm in the world, managing $9 trillion and providing management advising for investors holding many trillions of dollars more (Reiff,February 2021).

As Phillips (2018) shows, BlackRock is cross-invested with financial conglomerates from around the world that themselves bring together thousands of individual, group, and institutional investors and trillions of dollars, and at the same time it is deeply invested in the leading global industrial and service firms. China Investment Corporation holds 2,1 percent of Blackrock shares, the Kuwait Investment Authority holds 5,24 percent, Temasek Holdings Limited from China holds 3,9 percent, among other investors in BlackRock2. But this tells a very limited story of the transnational rather than U.S. nature of the trail of Apple profits beyond Apple itself – indeed; such a methodology of analysis that tries to determine the nationality of distinct portions of ownership of the mass of transnational capital misses the mark entirely. For instance, Wellington Management owns 3,1 percent of BlackRock shares. While it is based in Boston it has investors from institutions in over 60 countries3. BlackRock derives nearly 80 percent of its revenues from investment advisory and administrative fees and securities lending (Reiff, February 2021) as well as from dividends from the firms in which it is invested, so that the company is itself appropriating value that in the first instance was appropriated by Apple from subcontracted industrial capitalists and then had been previously reappropriated by transnational finance capital. In other words, if Apple appropriates the lion’s share of value in the iPad commodity chain, that value is in turn appropriated by transnational finance capital in what are numerous points of appropriation and reappropriation through the global financial system.

2 This data is from Market Screener, accessed here on 10 June 2021: https://www.market screener.com/quote/stock/BLACKROCK-INC-11862/company

3 See, e.g., the Wellington page at Wikipedia: https://en.wikipedia.org/wiki/Wellington_ Management_Company

Hence, value does not park itself in Apple as a corporation. It moves on to global investors managed by the outsized asset management conglomerates such as BlackRock, State Street and Vanguard, that in the wake of the 2008 financial collapse have become lodged at the very core of global capitalism, as Maher and Aquanno (2021) among others have discussed. Institutional investors came to own in the wake of 2008 as much as 70 percent of the S&P 500, and among these, Vanguard, BlackRock or State Street became the largest shareholder in 438 of the 500 (Maher and Aquanno, 2021). The enormous concentration of power and control in these global financial management conglomerates is crucial to exponential expansion of fictitious capital. Krippner (2012) and Durand (2017), among others, have demonstrated the increasing portion of total profits going to finance in recent decades and especially since 2008, along with the increasing reliance of non-financial firms on income from their financial operations. «The power obtained through fictitious capital is translated into concrete power in the manipulation and appropriation of the real economy by financial leveraging», observes Hermeto. «This leverage occurs in a two-step process. First, it detaches itself from the real economy and inflates itself. Second, with its expansion in assets, it comes back to the real economy and takes over of most profitable sectors [SIC]. The fictitious capital has an immanent parasitic character; it needs a host to survive» (Hermeto, 2021:4).

In sum, financial markets concentrate wealth by appropriating value from other circuits that have, in turn, appropriated it from labor. Global speculators are able to appropriate values through new circuits that are in many respects irrespective of space and irrespective of «real» value or material production (Robinson, 2014). In the competition over shares of the total global surplus value it is transnational finance capital that has come to dominate. But to the extent that fictitious capital breaks away from its historic mooring in the «real» economy, more and more of this competition is over fictitious capital! – in particular, rising asset valuations in the stock market, land and real estate markets, and derivatives, that is, fictitious value. While much of this discussion is exploratory and must be pursued elsewhere, the key point with regard to the crisis is that the massive appropriations of value through the global financial system can only be sustained through the continued expansion of fictitious capital resulting in a further aggravation of the underlying conditions of the crisis.

Fictitious capital, as Duran (2017:55) notes, is «an incarnation of that capital which tends to free itself from the process of valorization through production». Historically this does not necessarily present itself as an insurmountable problem. Finance capital as credit historically plays a key role in the real economy of the production of goods and services, that is, of fundamental or material value, or to put it another way, in capital valorization through the production process. The autonomy of financial accumulation from fundamental value may expand or contract during long periods of growth, stagnation and crisis. But at this time the historic relationship between the relatively autonomous dynamic of financial accumulation and its underlying real value would appear to swing so heavily towards the former that it almost appears to break away: so gaping is the chasm between fictitious capital and the real economy that financial valorization appears as independent of real valorization. This independence, of course, is an illusion. If the system came crashing down the crisis would dwarf all earlier ones, with the lives of billions of people hanging in the balance. The unprecedented injection of fiat money into the financial system may result in a new kind of stagflation, in which runaway inflation is induced by such astronomical levels of liquidity even as acute inequality and low rates of profit prolong stagnation. A more optimistic possibility is that these injections may postpone the crash until such time as the real economy can «catch up» and close the chasm4. But this is a high-risk bet.

While the discussion here remains tentative, two things should be clear. First, the runaway expansion of fictitious capital made possible by financialization is all the more aggravated by the ability of transnational finance capital to appropriate value in new ways and autonomously from the real economy of goods and services. And second, this expansion, as Durand (2017:1) notes, implies «a growing preemption of future production», therefore aggravating the structural crisis of overaccumulation. Durand is correct to assert that the eruption of finance is nothing other than «capitalism running out of breadth» (Ibid). But could it be that capitalism manages to catch its breath again through digitally-driven productive expansion as digitalization results in a dramatic transformation of the real economy? Will the digital revolution now underway usher in new opportunities for accumulation and growth in the production of goods and services that becomes strong enough to support the hypertrophied financial system, that is, to restore some correspondence between finance and the material production of goods and services?

4 There are historical precedents for such a closure. Fernand Braudel noted that the expansion of financial capitalism in Europe from 1830 to 1860 eventually led to the acceleration of industrial production. Rudolph Hilferding made a similar argument in his analysis of how finance capital triggered German industrial expansion in the late nineteenth and early twentieth centuries. As discussed by Durand (2017:4-5).

The Second Informational Age

Structural crises such as those of the 1930s and the 1970s typically involve the transformation of patterns of capital accumulation and new rounds of expansion, often incorporating new cutting-edge technologies, such as synthetic materials, consumer durables, automotive and petrochemicals, and military-industrial technologies that drove the post-WWII boom. Early in the twentieth century, the Soviet economist Nikolai Kondratieff noted how the world economy, driven by new cutting-edge technologies, experiences cycles of some 40-50 years (called Kondratieff waves). In these cycles, rounds of expansion eventually becomes exhausted and are followed by downturns and crises, resulting in a reorganization of the system and new technologies that help launch a new cycle. Carlota Perez (2003) has more recently made a similar argument, following Schumpeter’s focus on business cycles and innovations. New technologies will take time to generate productive expansion, in her view, because returns remain high on industries employing already established technologies and they continue to absorb available finance. Once the established technologies become exhausted opportunities for profitable investment in them dry up and financialization ensues. But then new technologies are introduced and eventually attract financial investment as a new «technoeconomic paradigm» takes hold that ushers in a period of productive expansion. Perez does allow that the political and cultural patterns propitious to the new paradigm must become institutionalized in order for a period of expansion to get underway. Nonetheless, these and related approaches fall back too heavily on technological determination; they omit the causal centrality of social and class forces in struggle.

Global Capitalism appears now on the brink of another wave of restructuring and transformation based on a much deeper digitalization of the entire global economy and society. At the core of this new wave of technological development is more advanced information technology or so-called fourth industrial revolution technologies5. Led by artificial intelligence (AI) and the collection, processing and analysis of immense amount of data («big data»), the emerging technologies include machine learning, automation and robotics, nano and biotechnology, the Internet of Things (IoT), quantum and cloud computing, 3D printing, virtual reality, new forms of energy storage, and autonomous land, air, and sea vehicles, among others. Computer and information technology (CIT) first introduced in the 1980s provided the original basis for globalization. It allowed the TCC to coordinate and synchronize global production sequences and therefore to put into place a globally integrated production and financial system into which every country has become incorporated. Just as the original introduction of CIT and the internet in the late twentieth century profoundly transformed world capitalism, this second generation of digital- based technologies is leading to a new round of worldwide restructuring that promises to have another transformative impact of the structures of the global economy, society, and polity. It is hard to underestimate just how rapid and extensive is the current digital restructuring. According to UNCTAD data, the «sharing economy» will surge from $14 billion in 2014 to $335 billion by 2025. Worldwide shipments of 3D printers more than doubled in 2016, to over 450.000, and were expected to reach 6,7 million by the end of 2020. The global value of e-commerce is estimated to have reached $29 trillion in 2017, which is equivalent to 36 percent of global GDP. In that year, 277 million people made cross-border purchases through e-commerce. Digitally deliverable service exports amounted in 2019 to $2,9 trillion, or fifty percent of global services exports. By 2019 global internet traffic was 66 times the volume of the entire global Internet traffic in 2005, whereas Global Internet Protocol (IP) traffic, a proxy for data flows, grew from about 100 gigabytes (GB) per day in 1992 to more than 45.000 GB per second in 2017. And yet the world is only in the early days of the data-driven economy; by 2022 global IP traffic is projected to reach 150.700 GB per second, fueled by more and more people coming online for the first time and by the expansion of the IoT. Digitalization since its inception exhibits a network effect insofar as the gamut of human activities and social relations become plugged into the same ultimate language of streams of bits – that is, into ones and zeros. We are approaching a situation, or may well have arrived at it, in which every person on the planet is connected –for the most part directly although everyone indirectly– through a single common digital network. Already by 2015 more than thirty percent of the global population was using social media platforms. By 2019 there were 5,2 billion smartphones in operation worldwide and more than half the planet was online (Schwab and Malleret, 2020:27, 165).

5 There is a rapidly growing body of literature on these new technologies and the restructuring it is bringing about. See inter alia: Brynjolfsson and McAfee (2014); Ford (2015); Schwab (2016); Srnicek (2016); Foreign Affairs (undated); UNCTAD (2019); Zuboff (2019). See Robinson (2020a; 2022 in press) for my own extended discussion on digitalization and global capitalist restructuring, on which the discussion here draws heavily.

If the first generation of capitalist globalization from the 1980s on involved the creation of a globally integrated production and financial system, the new wave of digitalization and the rise of platforms have facilitated since 2008 a very rapid transnationalization of digital-based services. By 2017 services accounted for some seventy percent of the total gross world product (Marois, 2017) and included communications, informatics, digital and platform technology, e-commerce, financial services, professional and technical work, and a host of other non-tangible products such as film and music. This shift worldwide to a service-based economy based on the widespread introduction of fourth industrial technologies brings about a sea change in the structure of capitalist production towards the centrality of knowledge to the production of goods and services. This has involved the increasing dominance of intangible capital (literally, capital that is not physical in nature), what has alternatively been called «intellectual capital», «intellectual property», and «immaterial production», along with the associated concept of immaterial labor, cognitive labor, and knowledge workers, in reference to workers involved in immaterial production. Information is at the course of culture and culture is what sets our species apart from all others. Now as information moves to a qualitatively new plane in our material existence, we want to recall that information as social power is never independent of relations of production and the power dynamics embedded therein.

The Covid-19 pandemic has boosted the efforts of the giant tech companies and their political agents to convert more and more areas of the economy into these new digital realms (Robinson, 2020a; 2022, in press). At the center of global restructuring are the giant tech companies, among them Microsoft, Apple, Amazon, Tencent, Alibaba and Facebook6. These companies experienced astonishing growth in the 2010s. Added now to the earlier tech behemoths are Zoom, Netflix, and other companies boosted by the pandemic as well as tech firms such as Taiwan Semiconductor Manufacturing (TSM) whose expansion and market capitalization was ballooning even before the contagion. Zoom daily users jumped by 3.000 percent in the first four months of the pandemic. Moreover, there are now hundreds of up-and-coming tech firms from around the world that prospered during the pandemic and can be expected to expand rapidly as restructuring proceeds. Apple and Microsoft registered an astounding market capitalization of $1,4 trillion each in early 2020, on the eve of the pandemic. By the end of that year this figure had jumped to $2,08 trillion and $1,63 trillion, respectively. Amazon’s capitalization stood at $1,04 trillion going into the pandemic and had climbed to $1,58 trillion by the end of 2020. Alphabet (Google’s parent company) registered a $1,2 trillion capitalization, Samsung $983 billion, Facebook $779 trillion, and Alibaba and Tencent some $700 billion each. To give an idea of just how rapidly these tech behemoths have grown, Google’s market capitalization went from under $200 billion in 2008 to over one $1 trillion in 2020, or a 500 percent increase over the decade. Meanwhile, in just two years, from 2015 to 2017, the combined value of the platform companies with a market capitalization of more than $100 million jumped by sixtyseven percent, to more than $7 trillion.

6 For the multiple sources for the data in this paragraph, see Robinson, 2020a; 2022, in press.

A handful of the largest tech firms have absorbed enormous amounts of cash from transnational investors from around the world who, desperate for new investment opportunities, have poured billions of dollars into the tech and platform giants as an outlet for their surplus accumulated capital in search of profits. Annual investment in CIT jumped from $17 billion in 1970, to $65 billion in 1980, then to $175 billion in 1990, $496 billion in 2000, and $654 billion in 2016, and then topped $800 billion in 2019 (Federal Reserve Bank, 2020). As capitalists invest these billions, the global banking and investment houses become interwoven with tech capital, as do businesses across the globe that are moving to cloud computing and artificial intelligence. It is clear that the astronomical amounts involved in the market capitalization of the tech firms are largely a result of stock speculation. There appears to be an enormous gap difficult if not impossible to measure between the value of these companies’ material as-sets and their market capitalization, reflecting the same chasm between the real economy and fictitious capital discussed in the previous section. This is to say that the relationship between finance and production in the tech sector is the same as it is in the global economy at large.

But could this be a temporary relationship as investment in tech generates a productive reactivation and expansion? Productive recovery would require under the logic of capitalism that the rate of profit rises. This would come about, ceteris paribus, from a rise in productivity through digitalization without a corresponding rise in the overall wage rate, or at least that profits rise more quickly than wages. Data shows that from the 1980s and on, those corporations that transitioned to CIT were dramatically more productive than their competitors, managing to resolve the socalled«productivity paradox» (Brynjolfsson, Erik and Andrew McAfee, 2014:100-101), whereby the growth in productivity notably slowed starting in 1973, the date of the onset of a structural crisis and subsequent globalization7. One McKinsey report estimated in 2016 that global growth rates for the next 50 years would slow to almost half of the rate it enjoyed in the previous 50 years, from 3,8 to 2,1 percent. It pinned hopes on digital technologies as the major source of future growth (Kauffman et al., 2016).

7 The average growth of output per worker in the United States was 2,3 percent a year between 1891 and 1972. It was just 1,4 percent a year between 1972 and 1996, and 1,3 percent between 2004 and 2012, although it recovered historical levels between 1996 and 2004, corresponding roughly to the period in which computerized became generalized in industry and services. See Marin, (undated:117-118).

Digitalization is a «general purpose technology», meaning that, like electricity, it spreads throughout all branches of the economy and society and becomes built into everything. Those who control the development and application of digital technologies acquire newfound social power and political influence. In this process there emerge new configurations and blocs of capital (Robinson, 2020a). The rise of the digital economy involves a fusion of Silicon Valley with transnational finance capital –U.S. bank investment in tech, for instance, increased by 180 percent from 2017 to 2019 (CBinsights, 2019)– and the military-industrial-security complex, giving rise to a new triangulated bloc of capital that appears to be at the very core of the emerging post-pandemic paradigm. As this process deepens, those TCC groups that control general digitalization develop new modalities for organizing the extraction of relative surplus value and increasing productivity at an exponential rate. Hence the new technologies disrupt existing value chains and generate a reorganization among sectors of capital and fractions of the capitalist class. They allow the tech giants and digitalized finance capital to appropriate ever-greater shares of the value generated by global circuits of accumulation. If the real economy is to «catch up», as discussed above, it will be in the relationship of the tech sector to transnational finance capital. Is it possible that the massive entrance of financial capital into this sector will generate value production, and that rising profits in digitally-driven production will drive the «catch up»? There is no sign that this is occurring currently, but what may tip thescale could be state reform driven by mass protest, as I will discuss momentarily.

The apologists of global capitalism claim that the digital economy will bring high-skilled, high-paid jobs and resolve problems of social polarization and stagnation. It is true that the first wave of digitalization in the late 20th century resulted in a bifurcation of work, generating high-paid, highskilled jobs on one side of the pole, giving rise to new armies of tech and finance workers, engineers, software programmers, and so on. On the other side of the pole, digitalization produced a much more numerous mass of deskilled, low-wage workers and an expansion of the ranks of surplus labor (Robinson, 2020b). But the new wave of digitalization threatens now to make redundant much so-called «knowledge work» and to deskill and downgrade a significant portion of those knowledge-based jobs that remain. Increasingly, cognitive labor and gig workers face low wages, dull repetitive tasks, and precariousness. As «big data» captures data on knowledge-based occupations at the workplace and in the market and then converts it into algorithms, this labor itself is threatened with replacement by artificial intelligence, autonomous vehicles and the other fourth industrial revolution technologies. Indeed, even before the pandemic hit, automation was spreading from industry and finance to all branches of services, even to fast food and agriculture. It is expected to eventually replace much professional work such as lawyers, financial analysts, doctors, journalists, accountants, insurance underwriters and librarians (Robinson, 2022, in press).

Crises, let us recall, provide transnational capital with the opportunity to restore profit levels by forcing greater productivity out of fewer workers. This process described by the ever-prescient Marx is driven forward by the new wave of digitalization, accelerated now in hot-house fashion by the economic and social conditions thrown up by the pandemic. Since the 1980s almost all employment lost in the United States in routine occupations due to automation, for instance, occurred during recessions (for discussion, see Robinson, 2022, in press). The first wave of CIT in the latter decades of the twentieth century triggered explosive growth in productivity and productive capacities, while the new digital technologies promise to multiply such capacities many times over. Specifically, digitalization vastly increases the organic composition of capital, meaning that the portion of fixed capital in the form of machinery and technology tends to increase relative to variable capital in the form of labor. In laymen’s terms, digitalization greatly accelerates the process whereby machinery and technology replace human labor, thus expanding the ranks of those who are made surplus and marginalized.

It is certainly possible that restructuring will unleash a new wave of expansion. But any such expansion will run up against the problems that an increase in the organic composition of capital presents for the system, namely the tendency for the rate of profit to fall, a contraction of aggregate demand, and the amassing of profits that cannot be profitably reinvested. In the larger picture, the heightened structural power achieved by the TCC through globalization and financialization has enabled it to undermine redistributive policies and to impose a new labor regime on the global working class based on flexibilization and precariatization, or proletarianization under conditions of permanent insecurity and precariousness.

The International Labor Organization reported in 2019 that a majority of the 3,5 billion workers in the world either eked out a living (or attempted to) in the informal economy –that is, swelled the ranks of surplus labor–or worked in precarious arrangements, including informal, flexible, part time, contract, migrant, and itinerant work arrangements. Over the past four decades globalization has brought a vast new round of global enclosures as hundreds of millions have been uprooted from the Third World countryside and turned into internal and transnational migrants. Some of the uprooted millions are super-exploited through incorporation into the global factories, farms, and offices as precarious labor, while others are marginalized and converted into surplus humanity, relegated to a «planet of slums». Surplus humanity is of no direct use to capital. However, in the larger picture, surplus labor is crucial to global capitalism insofar as it places downward pressure on wages everywhere and disciplines those who remain active in the labor market.

While the wave of technological innovation now underway may hold great promise for the long run, under global capitalism, the social and political implications of new technologies –developed within the logic of

capital and its implacable drive to accumulate– point to great peril. In particular, these new technologies, ceteris paribus, will aggravate the forces driving overaccumulation and the expansion of the ranks of surplus humanity. They will enable the TCC and its agents to create nightmarish new systems of social control, hegemony, and repression, systems that can be used to constrain and contain rebellion of the global working class, oppositional movements, and the excluded masses. Criminalization, often racialized, and militarized control become mechanisms of preemptive containment, converging with the drive toward militarized accumulation with the potential to create a global police state. Already, we may be seeing the breakdown of consensual domination and a rise of coercive systems of social control as strategies for surplus population management.

Absent redistributive and regulatory reforms or state intervention to generate public or alternative forms of employment, this process only aggravates the structural crisis of overaccumulation. The question then becomes one of class struggle and political contestation. Can mass struggle by the popular and working classes force on the system a measure of redistribution, re-regulation, and social welfare investment that may offset the crisis into the future and give global capitalism a new lease on life?

Conclusion: Contested Futures

Thus far we have discussed the structural dimension of a global crisis. But the crisis is as much political as it is economic. Capitalist states face spiraling crises of legitimacy after decades of hardship and social decay wrought by neoliberalism, aggravated by these states’ inability to manage the Covid-19 health emergency and the economic collapse. Elites historically attempted to resolve the contradictions of capitalism through national state policy instruments. However, transnational capital has broken free in recent decades from the constraints imposed by the nation-state. The TCC and its political agents in states lack functional political structures to resolve the crisis, stabilize a global power bloc, and reconstruct capitalist hegemony, given the disjuncture between a globalizing economy and a nation-state-based system of political authority. Global elites have attempted to acquire supranational political authority through transnational state (TNS) apparatuses (see inter alia, Robinson, 2004, 2008, and especially 2014, chapter two). But the fragmentary and highly emergent nature of TNS apparatuses makes the effort problematic given both the dispersal of formal political authority across many national states and the loose nature of TNS apparatuses with no center, formal constitution, or enforcement capacity.

The more «enlightened» elite representatives of the TCC have been clamoring for transnational mechanisms of «governance» through a more powerful TNS (Robinson, 2017) that would allow the global ruling class to reign in the anarchy of the system in the interests of saving global capitalism from itself and from radical challenges from below. But this effort runs up against the contradiction between the accumulation function and the legitimacy function of national states. That is, the national state faces a contradiction between the need to promote transnational capital accumulation in its territory and its need to achieve political legitimacy and stabilize the domestic social order. Attracting transnational corporate and financial investment to the national territory requires providing capital with all the incentives associated with neo-liberalism, such as downward pressure on wages, deregulation, tax concessions, privatization, investment subsidies, fiscal austerity and on so. The result is rising inequality, impoverishment, and insecurity for working and popular classes, precisely the conditions that throw states into crises of legitimacy, destabilize national political systems, and jeopardize elite control.

Capitalist hegemony is breaking down. A 2020 survey (John, 2020) found that a majority of people around the world (56 percent) believe capitalism is doing more harm than good. Lack of trust in capitalism was highest in Thailand and India (seventy-five percent and seventy-four percent, respectively), with France close behind (69 percent). Majorities rejected capitalism in many Asian, European, Gulf, African, and Latin American countries. In fact, only in Australia, Canada, the United States, South Korea, Hong Kong and Japan did majorities disagree with the assertion that capitalism currently does more harm than good. A «global spring» is breaking out all around the world8. From 2017 to 2019, more than 100 major anti-government protests swept the world, in rich and poor countries alike, toppling some 30 governments or leaders and sparking an escalation of state violence against protesters (Carnegie Endowment for International Peace, 2020). However, this two-year period was but a peak moment in popular insurgencies that spread in the wake of the 2008 Great Recession; a veritable tsunami of mass rebellion not seen since at least 1968.

The uprising has a truly global character (Robinson, 2022, in press). From Chile to Lebanon, Iraq to India, France to the United States, Haiti to Nigeria, and South Africa to Colombia, mass struggles appeared in many instances to be acquiring a radical anti-capitalist character. These protests involved workers and often migrant workers, farmers, indigenous communities, women and feminists, students, prisoners and activists against mass incarceration, democracy and anti-corruption activists, anti-racists, those struggling for autonomy or independence, anti-austerity campaigners, and environmental advocates, among others9. In all of their diversity, these mass struggles have a common underlying denominator: an aggressive global capitalism in crisis than is pushing to expand on the backs of masses who can tolerate no more hardship and deprivation. It would seem that the contradictions of this crisis-ridden system have reached the breaking point, placing the world in a perilous situation that borders on global civil war.

8 I do not normally cite Wikipedia but one entry has perhaps the most comprehensive list of major protests in the twenty-first century with links to original or other sources:

9 For a survey and discussion of the global revolt and the challenges that it faces, see Robinson, 2022, in press.

The ruling groups cannot but be alarmed over mass popular discontent. They must figure out how to keep accumulating capital in the face of stagnation and at the same time maintain control by keeping a lid on rebellion. As protest spreads around the world they have turned to expanding a global police state (Robinson, 2020b). Savage inequalities are politically explosive and to the extent that the system is simply unable to reverse them or to incorporate surplus humanity it turns to ever more violent forms of containment to manage immiserated populations (Ibid; TNI,2021). As popular discontent has spread in recent years, the dominant groups have ramped up transnational systems of social control, repression and warfare –from mass incarceration to deadly new modalities of policing and omnipresent systems of state and private surveillance– to contain the actual and the potential rebellion of the global working and popular classes and surplus humanity. Moreover, as repression becomes more systematic and generalized, the system becomes more dependent on militarized accumulation, that is, on a global war economy that relies on perpetual state-organized war-making, social control, and repression, driven now by new digital technologies, in order to open up and sustain opportunities for profit making.

But there are mounting fissures within the ruling groups over how to manage the crisis and stabilize global capitalism. Infighting within their ranks is escalating as the global capitalist historic bloc constructed in the heyday of neoliberalism from the 1990s until 2008 unravels and as the post-WWII international system collapses. In recent years reformist elements among the transnational elite have expressed alarm that worsening inequalities fan mass revolt. They have scrambled to find ways to reform the system (Robinson, 2018; 2020). In his worldwide bestseller, Capital in the Twenty-First Century, french economist Thomas Piketty (2017) argued for a global tax on capital and redistribution through progressive tax reform. The book gained traction globally precisely because its prescriptions converge with the reformist agenda of a rising number of transnational elites and intelligentsia. Like Piketty, they have been calling for mildly redistributive measures, such as increased taxes on corporations and the rich, a more progressive income tax, the reintroduction of social welfare programs, greater state regulation of the market, public investment, and a «green capitalism».

Reformers appear now to pin their hopes on the possibility that the global economy can be revived through large-scale investment in infrastructure and in a «green capitalism» that brings together environmental and other fourth industrial revolution technologies with regulation of global markets and redistribution through tax policies. Following China’s lead in massive infrastructural investment, U.S. President Joe Biden proposed a multi-trillion-dollar infrastructure bill at the start of his administration in 2021. The bill would involve a massive giveaway to transnational corporations contracted to reconstruct the country’s infrastructure and would leave intact the prevailing class power relations. But unlike the giveaways to the banks, which are mostly recycled into further rounds of speculation, the program involves productive activity that could generate a snowball effect of productive investment. The G-7 countries and the OECD were also at work in mid-2021 drafting new cross-border tax rules that would include a minimum tax rate (Rushe, 2021). More significantly, the idea of a universal basic income (UBI) has been gaining ground among reformers and even among conservatives.

While neoliberal policies continue to dominate, the «Washington consensus» around them has cracked since 2008. As Gramsci noted early in the last century, ruling class rule requires ruling class ideas, and that these ideas achieve hegemony and become common sense. For ideas and ideologies to become a material force, that is, to shape political practices, there must be certain correspondence between these ideas and material interests. Beyond the extant reform proposals, an increasing number of elite

forums and corporate foundations are searching for a different set of ideas that may compete for hegemony with neoliberalism and its theoretical foundation in neoclassical economics. «Circumstances are ripe for the emergence of a new intellectual paradigm – a different way to think about political economy and the terms of a new twenty-first century social contract», observed one of these, the Hewlett Foundation, in a 2018 internal report (Kramer, 2018:2). The repudiation in recent decades of Keynesianism in favor of «free market orthodoxy», the report argued, served the system well but no longer does so in light of changing circumstances. «Wealth inequality –along with income stagnation, the hollowing out of the middle class, and increased economic insecurity– has in turn become one of the major causes, if not the major cause, of rising political and social tensions» (Ibid:16). It noted that a rising number of foundations, think tank, quasi-governmental and private elite forums have been working to «change the socioeconomic paradigm away from neoliberalism» (Ibid:22-23). Two years later, the Foundation announced a $50 million program to support the development of a post-neoliberal paradigm (Hewlett Foundation, 2020).

The capitalist system is by its nature expansionary. Cycles of crisis are followed by waves of expansion. In each earlier structural crisis, the system went through a new round of extensive (outward) expansion, that is, incorporation of new territories and populations into it – from waves of colonial conquest in earlier centuries, to the integration in the late twentieth and early twenty-first centuries of the former socialist bloc countries, China, India, the Third World revolutionary regimes, and other areas that had been marginally outside the system. There are very few territories and peoples around the world that have yet to be incorporated through this process of extensive expansion. Backed by authoritarian states, the TCC continues its predatory conquest in these places, such as stretches of the Indian countryside, witness currently to a massive wave of proletarianization as an agribusiness invasion does away with one of the last great bastions of peasant agriculture (Sing, 2020), or Amazonia where there are still pockets of local village life and subsistence communities. Meanwhile, global capital has been ruthlessly pursuing intensive expansion; the commodification of what were non-commodified spheres, such as health and educational systems, infrastructure and other public services, public lands and nature reserves, military and police forces, prisons, and most recently, outer space.

But could we see a different type of intensive expansion in which digital technologies drive a sharp rise in productivity and open up new opportunities for accumulation in the productive economy while redistributive and regulatory reforms increase aggregate global demand? The capitalist state, in its attempt to secure legitimacy and assure the reproduction of the social order as a whole, can and often does impose restraint on capital or push the process of capital accumulation in certain directions. Earlier waves of capitalist modernization in the wake of structural crises involved the class compromises of social democracy and state intervention to regulate the market. Capitalist globalization undercut the national state’s ability to capture and redistribute surpluses and brought an end to redistributive capitalism. Any viable reform project at this time would have to involve transnational mechanisms of regulation and redistribution. Such a project would have to be global since capital can flee from any national jurisdiction that imposes restrain on its freedom, and even at that, it would eventually run up against the same contradictions internal to capitalism that undermined the Keynesian model in the twentieth century. Beyond transnational policy coordination among states, the structural power that the TCC is able to exercise from above over states will surely undermine reform unless there is a mass counter-mobilization of power from below. It is only this mass mobilization from below that can impose a counterweight to the control that transnational capital and the global market exercise from above over capitalist states around the world. The New Deal and social democracy in the twentieth-century came about as a result of the clash between mass struggles from below for radical change and efforts of reformists from above to bring about more limited change in order to save capitalism from revolution. Can mass upheaval now tip the balance in favor of reforms that help bring about a renewed hegemony of productive over speculative financial capital and restabilize the system?

Infighting among the ruling groups may present opportunities for the popular classes to build broad political alliances. Are we headed for a new period of reform and stability, a revolutionary rupture with capitalism, a worldwide fascist dictatorship, or a collapse of global civilization – in the words of The Communist Manifesto, towards «the common ruin of the contending classes?». I do not have the answer to these questions precisely because the future depends on a host of political and subjective factors that make prediction difficult if not impossible. To reiterate, capitalism as a world system has proved remarkably resilient even as it has faced one crisis after another in its centuries-long existence, emerging renewed after each major crisis. It would be foolish to assume we are in the end game of global capitalism. The outcome is entirely contingent on how class struggles and politics play out.

We want to recall that even if a new period of digitally-driven expansion displaces the structural crisis temporally into the future, global capitalism will continue to generate social crises of survival and well-being for billions of people. Worldwide, 50 percent of all people live on less than $2,50 a day and a full 80 percent live on less than $10 per day. One in three people on the planet suffer from some form of malnutrition, nearly a billion go to bed hungry each night and another two billion suffer from food insecurity. Refugees from war, climate change, political repression and economic collapse already number into the hundreds of millions. The new round of digital-driven restructuring may turbo-charge the economy enough to usher in a period of rising profits and prosperity for the system as a whole even as millions –billions– sink into greater precariousness and desolation.

Short of overthrowing the system, the only way out of the social crisis for the mass of humanity is a reversal of escalating inequalities through a radical redistribution of wealth and power downward. The challenge for emancipatory struggles is how to translate mass revolt into a project that can challenge the power of global capital and bring about such a radical redistribution. To date, the global revolt has spread unevenly and faces many challenges, including fragmentation and for the most part the lack of coherent left ideology and a vision of a transformative project beyond immediate demands. A number of these struggles, moreover, have suffered setbacks, such as the Greek working-class movement and, tragically, the Arab spring. How to confront from below the TCC and its increasingly reckless rule? What type of a transformation is viable, and how to achieve it? Any rupture with global capitalism must gain force through efforts to bring about reform of a more radical nature than those pushed from above. A Green New Deal, a call first put out in the United States, proposes combining sweeping green policies, including an end to fossil fuels, with a social welfare and pro-worker economy that would include mass employment opportunities in green energy and other technologies (Chomsky and Pollin, 2020). Such a global Green New Deal, whether or not that is what it is called, may help lift the world out of economic depression as it simultaneously addresses the climate emergency and generates more favorable conditions for an accumulation of counter-hegemonic forces. But a global Green New Deal is not enough. If humanity is to survive, global capitalism must ultimately be overthrown and replaced by an ecosocialism.

References

Brynjolfsson, Erik and McAfee, Andrew (2014), The Second Machine Age: Work Progress, and Prosperity in a Time of Brilliant Technologies, New York: W.W. Norton.

Carnegie Endowment for International Piece, «Global Protest Tracker».Accessed on 19 January, 2021. Available in: https://carnegieendowment.org/publications/interactive/protest-tracker. The tracker is interactive and regularly updated.

CBinsights, Research Brief (2019), «Where Top US Banks are Betting on Fintech».20 August 2019, accessed on 18 July 2020. Available in:https://www.cbinsights. com/research/fintech-investments-top-us-banks/

Chomsky, Noam and Pollin, Robert (2020), Climate Crisis and the Global Green New Deal: The Political Economy of Saving the Planet, London: Verso.

Clelland, Donald, A. (2014), «The Core of Apple: Degrees of Monopoly and Dark Value in Global Commodity Chains», Journal of World-Systems Research, 20 (1), 82-111.

Cox, Ronald W. (2013), «Transnational Capital and the Politics of Global Supply Chains», Class, Race, and Corporate Power, 1 (1)._____ (2019), «The Crisis of Capitalism Through Global Value Chains», Class, Race and Corporate Power, 7 (1).

Durand, Cédric (2017), Fictitious Capital: How Finance is Appropriating Our Future, London: Verso.

Faulkner, Neil, and Hearse, Phil (2021), «Value and Surplus Through a Neoliberal Lens: Notes Towards a New Understanding of Marxist Economics». Anti-Capitalist Resistance, January 2021, accessed on 6 May 2021. Available in:lens-notes-towards-a-new-understanding-of-marxist-economics

Federal Reserve Bank of St. Louis, Economic Research, «Private Fixed Investment in Information Processing Equipment and Software». See continuously updated data in graph, U.S. Bureau of Economic Analysis, accessed on 18 July 2020. Available in: https://fred.stlouisfed.org/series/A679RC1Q027SBEA

Ford, Martin (2015), The Rise of the Robots, New York: Basic Books.

Foreign Affairs, The Fourth Industrial Revolution: A Davos Reader, published by Foreign Affairs, no specific editor, no indicated place or year of publication. The book is a collection of essays previously published in Foreign Affairs that appear to have been written in the 2010s.

General Accounting Office (GAO) (2011), «Federal Reserve System: Opportunities Exist to Strengthen Policies and Processes for Managing Emergency Assistance», GAO-11-696, July 2011, Washington, D.C.

Gereffi, Gary and Korzeniewicz, Miguel (1993), Commodity Chains and Global Capitalism, New York:Praeger.

Hermeto, João Romeiro (2021), «Social Transformation in a Time of Social Disruption», Dilemas: Revista de Estudos de Conflito e Controle Social, 14 (1),219-242.

Hewlett Foundation (2020), «Hewlett Foundation Announces New, Five-Year $50 Million Economy and Society Initiative to Support Growing Movement to Replace Neoliberalism», Hewlett Foundation press release, 8 December 2020. Accessed on 10 June 2021. Available in: https://hewlett.org/newsroom/hewlett-foundation-announces-new-five-year-50-million-economy-and-societyinitiative-to-support-growing-movement-to-replace-neoliberalism

International Monetary Fund (IMF) (2009), «Fiscal Implications of the Global Economic and Financial Crisis», IMF Staff Position Note, 9 June 2009, SPN/09/13, Table 2.1, pp. 7.Accessed on 9 May 2021. Available in: https://www.imf.org/en/Publications/IMF-Staff-Position-Notes/Issues/2016/12/31/Fiscal-Implications-of-the-Global-Economic-and-Financial-Crisis-22987_____ (2021), «Policy Responses to COVID19», April 2021.Accessed on 3 May 2020. Available in: https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19

John, Mark (2020), «Capitalism Seen Doing ‘More Harm than Good’ in Global Survey» Reuters, 19 January 2020, accessed on 15 May 2021. Available in: https://www.reuters.com/article/us-davos-meeting-trust/capitalism-seen-doingmore-harm-than-good-in-global-survey-idUSKBN1ZJ0CW

Kauffman, Duncan; Lin, Diaan-Yi; Sneader, Kevin; Tonby, Oliver and Woetzel, Jonathan (2016), «Overcoming Global Turbulence to Reawaken Economic Growth», McKinsey&Company, September 2016. Accessed on 10 June 2021. Available in: https://www.mckinsey.com/featured-insights/employmentand-growth/overcoming-global-turbulence-to-reawaken-economic-growth

Kramer, Larry (2018), «Beyond Neoliberalism: Rethinking Political Economy»,Hewlett Foundation (internal memorandum), 26 April 2018. Accessed on 10 June 2021. Available in: https://hewlett.org/library/beyond-neoliberalismrethinking-political-economy

Krippner, Greta, R. (2012), Capitalizing on Crisis: The Political Origins of the Rise of Finance, Cambridge, MA: Harvard University Press.

International Labor Organization (2019), «The Challenge of Job Recovery; World Employment and Social Outlook: Trends 2019», United Nations, Geneva.

Maher, Stephen and Aquanno, Scott M. (2021), «The New Finance Capital: Corporate Governance, Financial Power and the State», Critical Sociology, on-line edition, 2021. Available in: https://journals.sagepub.com/doi/full/10.1177/0896920521994170

Maki, Sydney (2021), «World’s $281 Trillion Debt Pile is Set to Rise Again in 2021»Bloomberg, 17 February 2021, accessed on 30 April 2021. Available in: https://www.bloomberg.com/news/articles/2021-02-17/global-debt-hits-all-timehigh-as-pandemic-boosts-spending-need

Marazzi, Christian (2011), The Violence of Financial Capital, Edizioni Casagrande,Bellinzona, Switzerland. Marois, Thomas (2017), «TiSA and the Threat to Public Banks», 21 April 2017, Transnational Institute, accessed on 18 July 2020. Available in: https://www.tni.org/en/publication/tisa-and-the-threat-to-public-banks